Giving to the Mountain Lion Foundation

With your essential support, the Mountain Lion Foundation can turn your hope into action to protect America’s lion. We can share and create a better future of coexistence for all.

You can make a gift right now, or explore the various options for giving including planned giving. The Mountain Lion Foundation’s federal tax ID number is 94-3015360.

Your gift will help drive our impactful community-based conservation work to fight the fear and ignorance which results in the death of nearly 4,000 mountain lions in the United States every year. From trophy and sport hunting to rodenticides, to death by depredations and vehicle strikes, our lion’s lives are in jeopardy.

Ten lions, kittens or cubs are killed every single day.

Your gift will also protect mountain lions in areas where they are threatened or endangered like Southern California, Nebraska and Florida. As a Mountain Lion Foundation supporter, you have a role to play – each and every one of you can make a difference.

Your generosity means we can partner with others to restore and grow critical habitat, improve farming and ranching practices, and empower current and future generations to be amazing change makers.

With many ways to save America’s lion, how would you like to help?

As a monthly supporter of the Mountain Lion Foundation, you can do all that and more.

As a monthly supporter of the Mountain Lion Foundation, you can do all that and more. The Mountain Lion Foundation works with Charitable Adult Rides & Services (CARS) to administer our vehicle donation program. CARS is also a 501(c)(3) nonprofit and they also benefit from your donation.

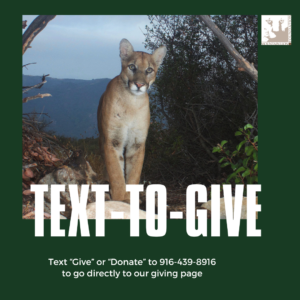

The Mountain Lion Foundation works with Charitable Adult Rides & Services (CARS) to administer our vehicle donation program. CARS is also a 501(c)(3) nonprofit and they also benefit from your donation. Text to Give

Text to Give